RBI Rate Cut on Hold, Likely Delayed Until December

The Reserve Bank of India (RBI) is getting ready to make its next statement on monetary policy next week. Most economists believe that an announcement by the RBI will remain at the current repo benchmark rate (6.5 percent) at this time.

It’s possible to see the possibility of a one-time rate cut this year however, most economists believe that it’ll be within the November-December quarter (Q4) instead of sooner. The forecast for this isn’t as certain and there isn’t a clear consensus in the field of expertise.

Here’s the breakdown of prediction:

- Repo Rate to Hold for June Most economic experts (71 out of) interviewed by Reuters believe that the RBI will maintain rates for repo at 6.50 percent during the meeting in June.

- Rate Cut Supposed for the fourth quarter of this year: Around half of the economists (33 out of 70) expect the first rate cut for repo to happen in the quarter ending 2024. They anticipate a cut from 6.25 percentage.

- The End of Year Rate Outlook When the year comes to an end the forecasts are varying. Three-quarters of the economists (33 out of 70) anticipate rates to be 0.25 percent less (at 6.25 percent) and others anticipate additional cuts (down to 6.00 percentage or 5.75 percent). But, a few (18 out of 70) think there will not change rates until 2024.

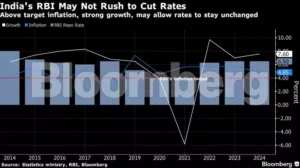

This is despite the fact that inflation will likely remain over the target range set by the RBI (2%-6 percent) between 2024 and 2025.

Inflation and Growth Outlook:

- The inflation rate is predicted to stay at or above 4% through 2024 and 2025. This will be above the target range set by RBI.

- The growth of India’s economy is expected to be average 6.8 percentage for the current fiscal year as well as 6.6 percentage in the coming year.

Global Influence:

The slowing of rate cuts from the other central banks of major importance such as that of the US Federal Reserve, is contributing to the RBI’s cautious behavior.

All in all In general, the RBI is more concerned with preventing inflation than encouraging growth in the near in the near future.

Additional Economic Forecasts:

- Inflation in India is predicted to drop to 4.00 percent in the coming quarter, but then it will rise to 4.00% in the following quarter before rising again. Inflation in the current and coming fiscal year is anticipated to be in the range of 4.5 percentage.

- The growth in the economy is expected to be 6.8 percent in this fiscal year, and 6.6 percent in the following.

- The RBI In the annual reports, predicted the growth of India’s GDP at 7percent for this fiscal year.

Global Context Major central banks, such as that of the US Federal Reserve likely delaying rates, the need on the RBI to act quickly is diminished.